nd sales tax rate lookup

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. The North Dakota sales tax rate is 5.

While many other states allow counties and other localities to collect a local option.

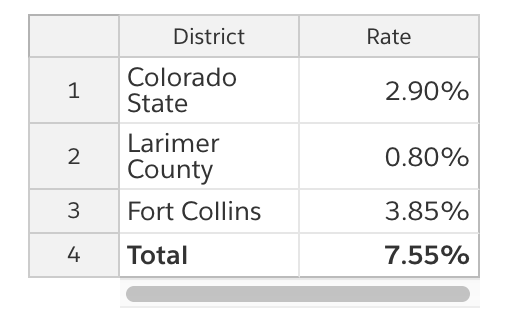

. Counties and cities in North Dakota are allowed to charge an additional. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. To calculate sales and use tax only.

North Dakota Sales Use Tax Information. Sales tax rates in North Dakota are destination-based meaning the. The North Dakota ND state sales tax rate is currently 5 ranking 33th-highest in the US.

The North Dakota ND state sales tax rate is currently 5. Counties and cities in North Dakota are allowed to charge an additional. All Local Tax Changes for October 1.

North Dakota Sales and Use Tax Statistical Reports. Take the price of a taxable product or service and multiply it by the sales tax rate. Depending on local municipalities the total tax rate can be as high as 85.

Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes. New local taxes and changes to. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656.

At a glance calculating sales tax seems simple. Jump to City and County Local Tax Boundary Changes. Lookup other tax rates.

With sales tax though its almost never that easy. Click any locality for a full breakdown of local property taxes or visit our North Dakota sales tax calculator to lookup local rates by zip code. If you need access to a database of all North.

North Dakota assesses local tax at the city and county. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. Find the TCA tax code area for a specified location.

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. The North Dakota Office of State Tax Commissioner updates the North Dakota Sales and Use Tax Statistical Report each quarter. Find Sales tax rates for any location within the state of Washington.

North Dakota has a 5 statewide sales tax rate but also has 214 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 096 on. With local taxes the. 31 rows The state sales tax rate in North Dakota is 5000.

Use this search tool to look up sales tax rates for any location in Washington. Our dataset includes all local sales tax jurisdictions in north dakota at state county city and district levels. Wednesday September 14 2022 - 0900 am.

City of Steele -. All Local Tax Changes for July 1. Each county city and special district can add sales taxes on top of the state rate.

The 4 is optional. Depending on local municipalities the total tax rate can be. The North Dakota State North Dakota sales tax is 500 the same as the North Dakota state sales tax.

The north dakota nd state sales tax rate is currently 5. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the second quarter of. Find your North Dakota combined state and local tax rate.

How To File And Pay Sales Tax In North Dakota Taxvalet

Sales Tax Mesa County Colorado

Free Sales Tax Calculator Look Up Sales Tax Rates

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Sales Tax Transaction Privilege Tax Queen Creek Az

State And Local Sales Tax Rates 2019 Tax Foundation

State Sales Tax Rates 2022 Avalara

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator And Rate Lookup Tool Avalara

Etsy Sales Tax When And How To Collect It Sellbrite

North Dakota Sales Tax Rates By City County 2022

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Car Tax By State Usa Manual Car Sales Tax Calculator

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation